The power to create money is equivalent to splitting the atom.

John Law (1671--1729) is a forgotten prophet of economic theory, though everything we do today is based on his Money and Trade Considered: with a Proposal for Supplying the Nation with Money (1705). Schumpeter described him as “in a class by himself … in the front ranks of monetary theorists of all time.”

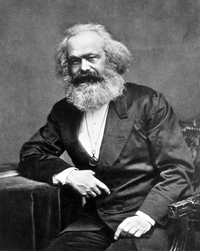

But it was Marx that really understood Law, “the pleasant character mixture of swindler and prophet.” Law’s misuse of his own theory exposed in embryo, spectacularly (and disastrously), how the stock market and speculation would lead to “a new mode of production”, where “enrichment through exploitation of the labour of others [becomes] the purest and most colossal form of gambling and swindling,” reducing “more and more the number of the few who exploit the social wealth.”

1893, 1929, 2008, anyone? Law was dismissed as a charlan and murderer,* the confidence man behind the Mississippi bubble in 1720. A Scottish economist who believed that money was only a means of exchange that did not constitute wealth in itself, and that national wealth depended on trade. Did I hear ‘banking is theft’ and ‘globalization’?

Gold as money: misplaced concreteness

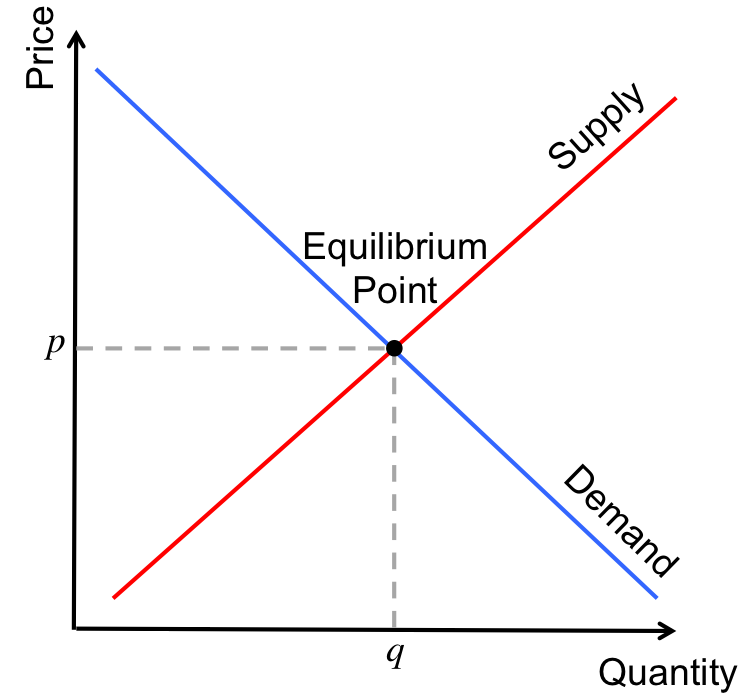

Adam Smith took Law’s trade angle and spun it into his Invisible Hand. Smith plagiarized Law’s theory of value as based on supply  and demand. He used Law’s diamond example of something that was both scarce (i.e., takes lots of labour to produce) and in high demand, which gave it ‘value’.

and demand. He used Law’s diamond example of something that was both scarce (i.e., takes lots of labour to produce) and in high demand, which gave it ‘value’.

Money is the exception. It only represents the value by which commodities are exchanged, not having value per se. Worshipping gold as the magic substance that God gave to manage our economies is a classic case of Whitehead’s misplaced concreteness -- attributing an abstract quality to a physical substance.

Why do we think of gold** as money? As valuable? It is accepted as a reliable measure of exchange because its supply is scarce and it has demand (having a use ‘value’ in itself). But it creates trouble (deflation -> recession) because of its extreme scarcity. We can do better. That’s what Law figured out.

From gambler to economist

Law came by his interest in money naturally, as his father was Deacon of the Goldsmiths of Edinburgh. He was a lazy student and forewent university for hedonism and adventure, frittering away his inheritance.*** He applied his mathematical skills to gambling, recouped his fortune, and was appointed Controller General of Finances of France under the Duke of Orleans (regent to Louis XV).

Paper currency was Law’s bombshell. China had it from the 7th century, based on merchant receipts of deposit, though copper coins remained the basis of Chinese currency. In Europe, banknotes first appeared in 1661 in Sweden, guaranteed by the state, backed by gold. Law went a step further, establishing the Banque Générale in 1716, three-quarters of its capital consisting of French government bills and notes, effectively making it the central bank de la France, one of first in history, putting the state in charge.*** No need for gold backing.

Law realized what looks too simple to be true: that money creation will stimulate the economy, that paper money is preferable to metallic money, and that shares are the highest form of money since they pay dividends. Money producing money. Swindler? Confidence trickster? Yes, but blame capitalism, not Law.

He argued that anything could act as backing for money: gold, silver, land. But that ultimately, the backer was the sovereign. The buck/ sovereign stops here. As long as the sovereign is wise and everyone had confidence in him, there will be no bank runs; the economy will purr along.

Gold was traditionally the standard, because its scarcity acted as a strict control mechanism on an overly ambitious monarch. The king could at best debased his gold coins, but could only fool people so far, as price inflation set in with excessive spending.

Law’s policy of using state backed money to stimulate employment and regulate the economy trickled down from the 1930s on, but only when capitalism was in danger of being replaced by socialism. It took the desperation of the US economy hemorrhaging during the Vietnam war for his theory of fiat money to explode onto the world stage. On the 300th anniversary of his birth in 1971, Nixon took the US off the gold standard, making the world’s money the US dollar. Period. Nixon became our ‘wise monarch’, though in deference to the banksters, he didn't go as far as Lincoln's greenbacks and take away their money creating power.

Bubble economics

Law was working for Louis XV in the 18th century, not a reliable monarch to be the producer of money, and there were only the crudest statistics about the economy at that time.

The wars waged by Louis XIV had left the country completely wasted, both economically and financially. The resultant shortage of precious metals led to a shortage of coins in circulation, which in turn limited the production of new coins. Law proposed to stimulate industry by replacing gold with paper credit and then increasing the supply of credit.

As Controller General of Finances in 1720, Law effectively had control over external and internal commerce. His policies both dramatically increased trade and economic activity. He tried to break up large land-holdings to benefit the peasants; he abolished internal road and canal tolls; he encouraged the building of new roads, the starting of new industries (even importing artisans but mostly by offering low-interest loans), and the revival of overseas commerce—and indeed industry increased 60% in two years, and the number of French ships engaged in export went from sixteen to three hundred.

Galileo sans telescope

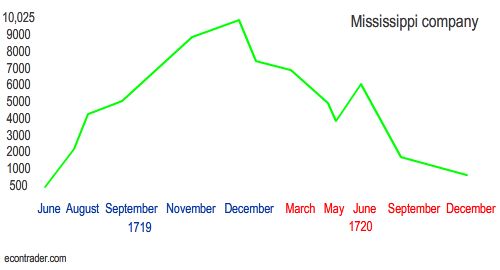

Law was économiste extraordinaire, the darling of Europe. But he was under Louis’ thumb. Louis took Law’s secret formula and ran  with it. His wild spending created a mess, printing money that was used to build his palaces and to purchase the shares in Law’s brainchild, the Mississippi Company. That gained a crazed momentum of its own, leading to the bubble.

with it. His wild spending created a mess, printing money that was used to build his palaces and to purchase the shares in Law’s brainchild, the Mississippi Company. That gained a crazed momentum of its own, leading to the bubble.

During the stock market bubble, the rush to convert paper money to coins led to sporadic bank hours and riots. Squatters now occupied the square of Palace Louis-le-Grand and openly attacked the financiers that lived there. It was under these circumstances and the cover of night that John Law fled Paris in disgrace, barely saving his own neck.

The peaceful atom

To get it right means having

*a stable ruler (NOT an absolute monarch or a populist demagogue), and

*sophisticated statistical instruments to estimate the amount of money needed in production/ consumption, and its velocity of turnover.****

The power to create money is equivalent to splitting the atom. Money mobilizes society’s Energy, and economics' Einstein realized it equals the social equivalent of Mass times the Speed of light squared, something like labour power (supply) times desires (demand). As Meyer Rothschild said: Give me control of the nation’s money supply, and I control the nation. Unleashing Law’s theories in the 18th century could only lead to disaster.

It’s fine for Louis to create the money, but not for his own luxuries/ wars; rather, for the good of his people, and according to the needs of the economy.

So who should create the money?

In the first place, it is essential to take the money creating role away from banks. Their interest is ‘interest’, profit. Period. Not social well being. Secondly, the 2008 financial crisis demonstrated once again that bankers are always tempted to gamble, that they should be limited to issuing loans based on 100% of their reserves, i.e., full reserve banking).

Sovereign money should be issued by a central bank under the direct authority of the ‘sovereign’, society's embodiment. Why leave the real economic decisions up to bankers? Let the state determine how the economy should develop, using as its secret weapon the creation of money (with proper oversight and the help of well-intentioned investment bankers). Atomic power used rationally.

Ultimately Law failed as policy-maker, in part because of the profligate king and the entrenched interests of the day, in part because of the lack of statistical instruments. It’s time to ‘take up the torch’.

xxx

*He killed an opponent in a duel and was sentenced to death, later commuted to a fine. The victim’s brother appealed and Law had to escape to Amsterdam. After his spectacular career as French finance minister, he pined away abroad, and died in poverty, forgotten to all.

**Silver or copper are too plentiful, making storage a problem

***His mother rescued the family home, buying it from him to pay off his debts

***There were six such banks that issued paper money, along with Sweden, England, Holland, Venice, and Genoa.

^Velocity of money = Nominal GDP/ money in circulation